How to Make Money in a Crazy Market Without Losing Your Mind

A Simple Way to Grow Your Savings When the Stock Market Feels Like a Rollercoaster

Hey, you ever feel like your savings are just sitting there, doing nothing, while the world’s going nuts? Like, one day the stock market’s crashing because of some tariff drama, and the next it’s soaring because, well, who even knows why? It’s stressful.

You want to grow your money, but the idea of investing feels like jumping into a casino blindfolded. Been there. Here’s the deal: I’m gonna share a dead-simple way to dip your toes into the stock market without losing sleep. It’s worked for me, and it’s helped friends who were total newbies. Keep reading, and I’ll walk you through how to start small, stay smart, and maybe even have some fun.

The Problem: You’re Scared to Invest (and That’s Okay)

Let’s be real. Most of us aren’t Wall Street wizards. We’re just trying to pay rent, maybe save for a vacation, or not freak out about retirement. But leaving your money in a savings account? It’s like watching it slowly shrink—thanks, inflation. As of May 2025, inflation’s still hovering around 3%, eating away at your cash. Investing sounds great, but the market’s wild swings make it feel like you’re betting your life savings on a coin flip. I get it. I was terrified to start, too.

The good news? You don’t need to be a genius to make money in the market. You just need a plan that’s simple and keeps your stress low.

My Go-To Fix: Buy Boring, Solid Stocks (Like Beer)

Here’s what I do, and it’s stupidly straightforward. I look for companies that are boring but reliable—think stuff people buy no matter what. Like, toothpaste, coffee, or… beer.

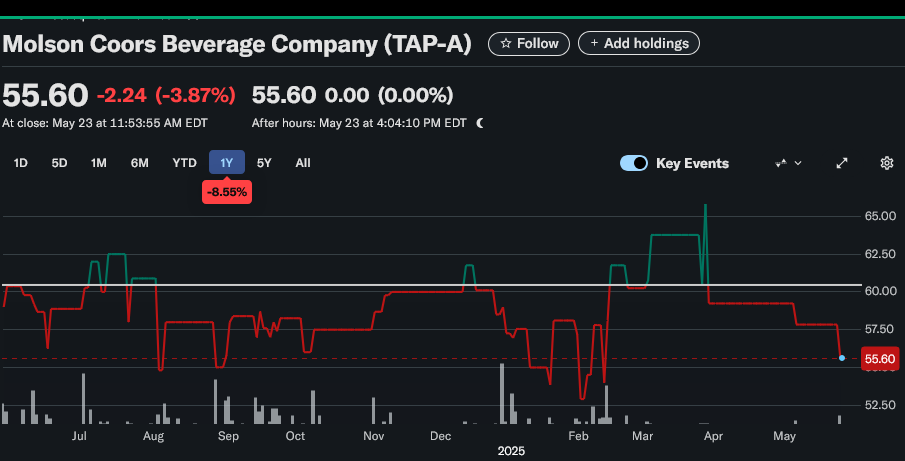

Yeah, I said beer. I stumbled across Molson Coors Beverage Company (the Coors beer people) a while back. It’s a “consumer staples” stock, which means it’s as essential as diapers or dish soap. Wild, right? But it makes sense—people drink beer in good times and bad.

Why Molson Coors? It’s cheap right now, pays a steady dividend (about 3.5% as of May 2025), and analysts are giving it a thumbs-up. I bought some shares last year, and it’s been a quiet little win. Dividends hit my account like clockwork, and I’m not sweating every market dip. It’s not gonna make me a millionaire, but it’s padding my savings while I figure out bigger moves.

Here’s how you can do it:

- Start Small: You don’t need thousands. Apps like Robinhood or Fidelity let you buy one share (Molson Coors is around $60 as of now). Use money you won’t miss for a while.

- Pick Boring: Look for “consumer staples” stocks. Think Procter & Gamble, Coca-Cola, or, yeah, Molson Coors. These don’t tank as hard when the market freaks out.

- Check Dividends: Dividends are like free cash companies pay you for holding their stock. Look for ones with a history of paying steadily (Google “dividend aristocrats” for ideas).

- Set It and Forget It: Don’t check your stocks every day. It’ll drive you nuts. Check monthly, sip some coffee, and chill.

I’ve seen this work for friends, too. My buddy Jake, who’s 30 and barely knows stocks from socks, started with Coca-Cola shares. He’s made a couple hundred bucks in dividends and feels like a pro. It’s not sexy, but it’s progress.

Why This Matters Now

The market’s been a mess lately. Tariff threats in early 2025 tanked stocks, then they bounced back when the news cycle calmed down. It’s like a soap opera.

But here’s the thing: chaos creates deals. Stocks like Molson Coors are undervalued right now, meaning you can buy low and wait for them to climb. Data from Yahoo Finance shows consumer staples are outperforming tech stocks this year—steady wins the race.

You don’t have to time the market perfectly. Just start. Every dollar you invest now is a dollar working harder than it would in a bank.

Okay, But What If It All Crashes?

I hear you. Markets can be scary. My first year investing, I panicked every time the news screamed “crash.” But here’s what I learned: boring stocks like Molson Coors don’t drop as hard, and they recover faster.

Plus, those dividends keep coming even when the market’s sulking. If you’re super nervous, only invest what you can afford to leave alone for a year or two. And maybe talk to a financial advisor for a quick gut-check—I did, and it helped me sleep better.

Let’s Wrap This Up

Investing doesn’t have to be a headache. Start with something simple, like a solid stock that pays dividends. It’s like planting a tiny money tree and watching it grow. Molson Coors is my pick, but find what clicks for you. The market’s wild, but you don’t have to be. Take a small step, and you might be surprised how good it feels to see your money work.

So, what’s stopping you from giving it a try? Got a stock you’re eyeing, or just wanna chat about it? I’m all ears—let’s figure it out together.